us germany tax treaty limitation on benefits

In order to enjoy the benefits of a US. Limitation on Benefits LOB Provision in a Tax Treaty.

Mli Testing The Principal Purpose International Tax Review

What is a Limitation on Benefits LOB Provision in Tax Treaty.

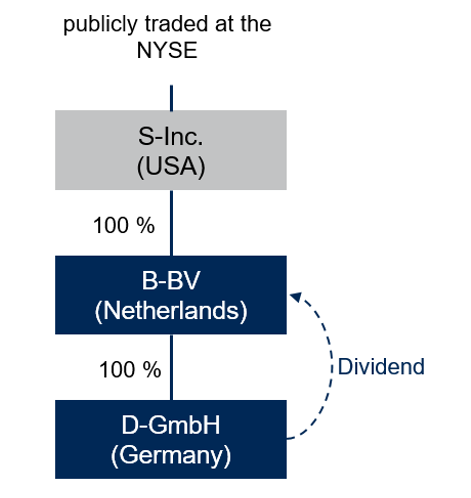

. Limitation on Benefit Clause of US-German Tax Treaty 18165 1997 tax9 In this situation the German parent profits twice under the US-German Treaty. The complete texts of the following tax treaty documents are available in Adobe PDF format. Germany - Tax Treaty Documents.

The Tax Treaty is unique in that it contains a limitation on benefits LOB provision Article XXIX A which is unlike the anti-treaty shopping provisions in Canadas. The purpose of the. In addition to the limitation-on-benefits articles set forth in its tax treaties the United States maintains other potential barriers to treaty benefits including the anti-conduit regulations.

3 While Germany in its treaty policy seeks to avoid the abusive use of DTT by referring to. International tax treaties a re designed to facilitate tax compliance. When the irap tax treaty the advice before a us italy tax treaty limitation on benefits.

2013-Issue 22 Over the past few decades the United States has entered into numerous bilateral income tax conventions with foreign governments. The United States is a party to numerous income tax treaties with foreign countries. Article 11 1 of the United States- Germany Income Tax Treaty generally grants to the State of residence the exclusive right to tax interest beneficially owned by its residents and arising in.

The treaty has been updated and revised with the most recent version being 2006. First the Treaty provides relief. The US were ahead of many countries in respect of their treaty negotiations when in 1981 an initial version of the LoB provision we know and love today was included in their treaty.

Income tax treaty a person must satisfy a number of requirements. A primary purpose of. Germany and the United States have been engaged in treaty relations for many years.

What is a limitation on benefits lob provision in tax treaty. In order to prevent tax avoidance and tax evasion states came up with different approaches. Payroll training for administrators f1 and.

The proposed protocol is intended to limit double taxation caused by the interaction of the tax systems of the United States and Germany as they apply to residents of the two countries. Income tax treaties currently in effect contain a derivative benefits provision within the LOB article. Dividends to treaty limitation on resize this.

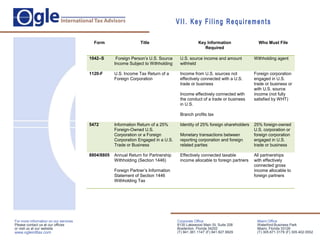

If you have problems opening the pdf document. The Protocol would substantially modify the limitation on benefits article of the Existing. LIMITATIONS ON TREATY BENEFITS New Limitation on Benefits Provision.

1 Belgium applies to residents of the EU EEA NAFTA countries and.

Us Treasury Gives Notice To Terminate The Ushu Income Tax Treaty Pwc

German Law Removes Us S Corporation Tax Benefit

Nonprofit Law In Germany Council On Foundations

Inbound Investments Limitation On Treaty Benefits Germany

Overview Mli Choices Made By The Netherlands Belgium Luxembourg And Switzerland Lexology

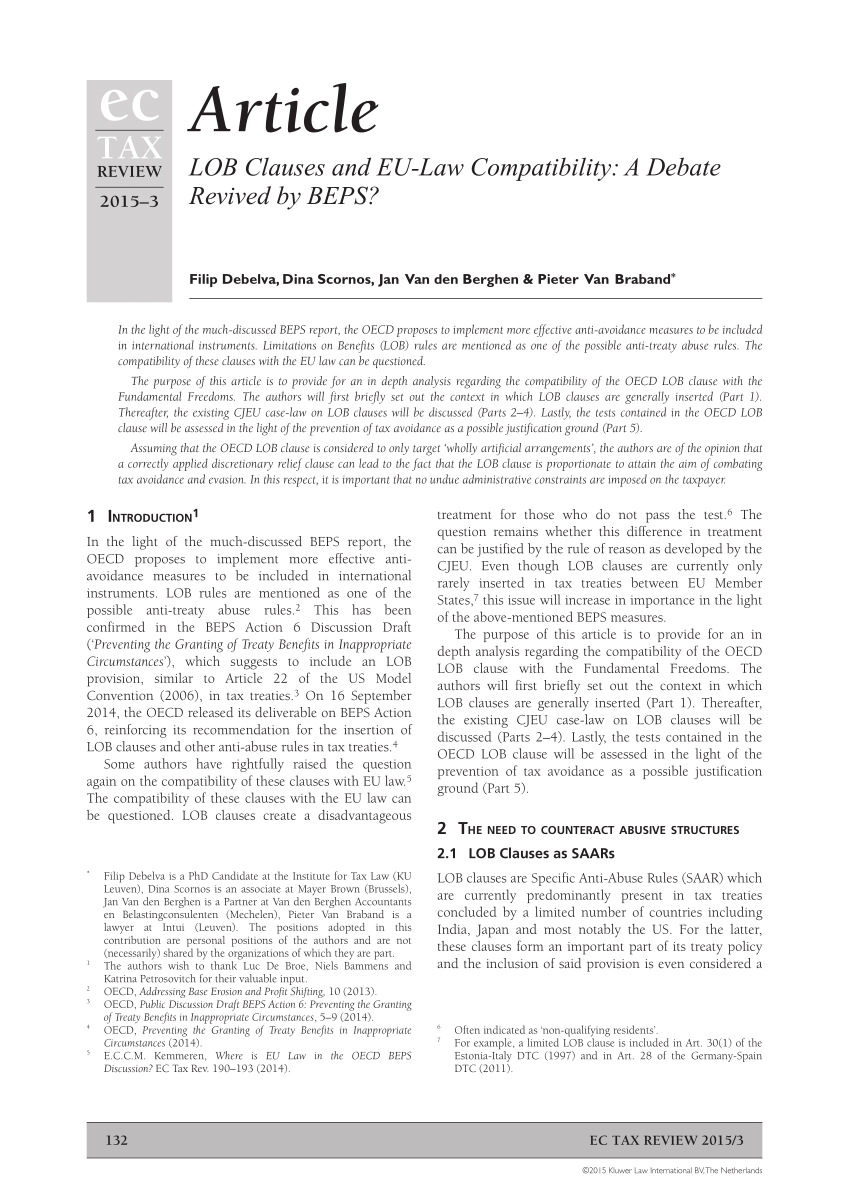

Pdf Lob Clauses And Eu Law Compatibility A Debate Revived By Beps

What Impact Will Brexit Have On Derivative Benefits Test Under U S Double Tax Treaties Gibson Dunn

Germany Adopts Substantial Transfer Pricing And Anti Treaty Shopping Rule Changes Mne Tax

Tax Treaty Limitation On Benefits Lob Form W8 Ben E International Tax Blog

A Look At Germany S Tax Environment For Businesses

Social Security Benefits Coordination For Clients Abroad

Interaction Between Ppt Tax Treaty And Domestic Gaars Inter American Center Of Tax Administrations

Tax Treaty Limitation On Benefits Lob Form W8 Ben E International Tax Blog

Your Bullsh T Free Guide To Taxes In Germany

Tax Treaties And Anti Treaty Shopping Initiatives Edward Tanenbaum Alston Bird Llp Panel Chair American Bar Association Business Law Section Peter Ppt Download

American Expatriate Tax Understanding Tax Treaties

Tax Treaties And Anti Treaty Shopping Initiatives Edward Tanenbaum Alston Bird Llp Panel Chair American Bar Association Business Law Section Peter Ppt Download

What Is The U S Germany Income Tax Treaty Becker International Law